Today, the global economy is filled with uncertainties. Will inflation rise or fall? Can stock markets resume their upward climb? Will consumer spending increase in the next few months? But if you are an IT professional in a large-scale enterprise, you can probably expect to see continued investment in your digital transformation initiatives.

A recent Gartner survey of more than 200 CFOs found that 69 percent plan to increase their spending on digital technologies. “Companies will use digital technology primarily to reshape their revenue stream, adding new products and services, changing the cash flow of existing products and services, as well as changing the value proposition of existing products and services,” said John-David Lovelock, distinguished VP analyst at Gartner. “However, as organizations look to also realize operations efficiency, cost reductions or cost avoidance during the current economic uncertainty, more traditional back-office and operational needs of departments outside IT are being added to the digital transformation project list.”

In other words, your organization may have a fresh list of IT initiatives in the months ahead, and you should be paying close attention to changing C-suite priorities as well as business unit requirements. As Lovelock said, “There is a shift from buying technology to building, composing and assembling technology to meet specific business drivers. This shift is foundational to the growth of cloud over on-premises for new IT spending.”

A worldwide rise in spending

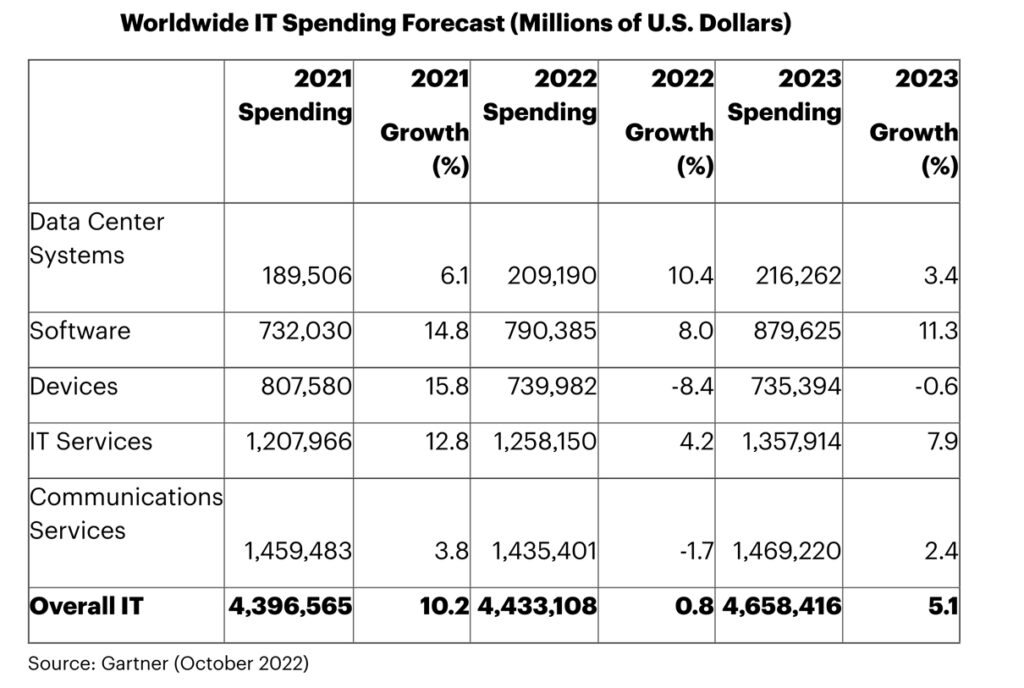

The latest forecast from Gartner projects worldwide IT spending will total $4.6 trillion in 2023, an increase of 5.1 percent from 2022. “Enterprise IT spending is recession-proof,” said Lovelock. “Economic turbulence will change the context for technology investments, increasing spending in some areas and accelerating declines in others, but it is not projected to materially impact the overall level of enterprise technology spending.”

Looking at the different sectors, Gartner’s analysts noted that will be sufficient spending within data center markets to maintain existing on-premises data centers, but new spending will continue to shift to cloud options. From a vendor perspective, cloud computing revenues will rise $101 billion next year, while cloud spending will rise by about 20 percent for the next two to three years. Gartner’s forecast also projects 11.3 percent growth for software spending in 2023. However, spending for devices may be flat or decline, as inflation cuts into consumer buying power.

In the EMEA market, IT spending is forecast to total $1.3 trillion in 2023, an increase of 3.7 percent. That will be even higher in the most mature markets – Germany, France and U.K. – with a projected 5.2 percent increase year-over-year. “Businesses in EMEA will increase their IT budgets in 2023,” added Lovelock. “For example, they will use digital technology to help other departments realize operational efficiency and cost savings and deploy digital technology to transform their company’s value proposition, revenue, and client interactions.”

In the APAC market, India IT spending is projected to grow 2.6 percent in 2023, according to a separate Gartner forecast. “The headwinds are in favor of technology as businesses realized how going digital can benefit them in the long run,” said Arup Roy, VP analyst. “Depending upon the maturity level of the digital enterprise, the spending context may be different for different businesses, but overall technology spending will continue to be on the rise in 2023.”