With the self-service IVR, customers could easily tell the difference between machine and human assistance. Now, the lines are blurred with the growth of digital self-service channels increasingly supported by AI-driven voice and chatbots.

“Our customers are moving from scripted to conversational interactions,” said David Chavez, vice president, innovation and architecture, Avaya. “Our focus is building a platform that allows for the flexible inclusion of AI, driving the conversational flow between customer and agent and arming the agent with insights based on what’s happened previously with the customer.”

Chavez was a panelist at a recent Enterprise Connect session, “Contact Centers & CX: Blurring the Line Between Automation and Live Assistance.” Sheila McGee-Smith, president and principal analyst, McGee-Smith Analytics, led the discussion on finding the right balance between automation and human agents.

Eliminating silos of the business side, such as creating a chief customer officer, can help with integration of automated and human interactions, said Chavez, who expects automation to resolve the majority of customer interactions in the next few years.

“AI is not magic but science,” said Chavez. “It goes hand in hand with data, so the more data the better. AI also relies on a machine-learning model. No model is perfect, so you should implement a trap door for customers to get to a human rather than letting the AI struggle to understand what is needed.”

Using AI to boost CX

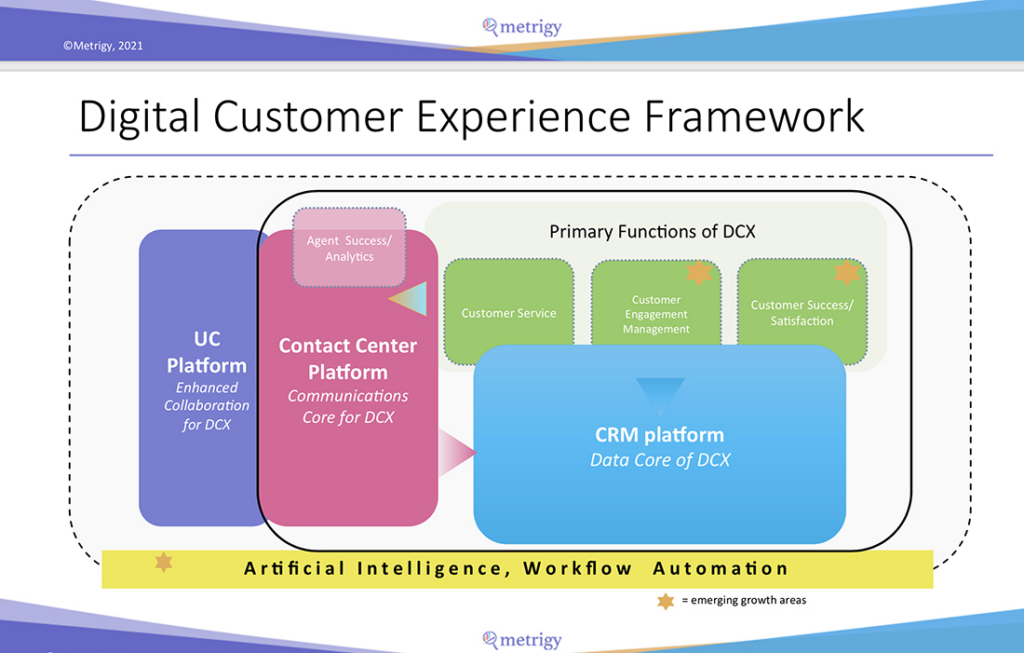

AI applications can drive success in the contact center by improving the customer and agent experience, according to Robin Gareiss, CEO and principal analyst, Metrigy. “If AI is not part of your CX strategy, you’re at a competitive disadvantage, she said in an Enterprise Connect session, “Top Uses of AI to Deliver Stellar Customer Experiences.”

In her talk, Gareiss focused on four key AI applications that can boost revenue, reduce costs or improve CX and the agent experience.

• Intelligent Routing. AI applications can help route questions to the best possible person leading to faster resolution, better customer ratings, greater agent efficiency, and cost reduction, she said. For instance, if AI detects a cross-sell opportunity, the call could be routed to an agent with a top sales record. On the other hand, a repeat caller cold be sent to an agent with high ratings for handling troubled customers. “There are all sorts of cool things you can do here,” Gareiss said.

• Virtual Assistants + Self Service. For this use case, Gareiss suggested starting at a basic level, such as providing locations, hours and addresses. “Then you can move up to more complex questions, such as requests to look up account balances or schedule service calls,” she said. “Virtual assistants can also provide callers with scripts to meet company rules or federal regulations, and then be able to elevate to a live agent at any point in the journey.”

• Workforce Optimization. AI applications can supplement the current workforce. “That’s an important consideration as there is a shortage of contact center agents, especially in verticals like financial services,” Gareiss said.

• Voice Biometrics. AI is well suited to measure characteristics in someone’s voice, such as comparing a spoken and a stored phrase. No only does this help to prevent fraud, it can save 30 to 60 seconds per call, said Gareiss. “That doesn’t sound like much but when you multiply the number of daily calls each agent handles by your workforce, that can be a significant cost reduction.”

But before adding or enhancing AI applica0ons, Gareiss emphasized the importance of building a business case. Identify the issue, determine the metrics for success, and press for a solid budget. “If your AI application is driven by the right reasons and implemented correctly it will likely drive business success.”